Managing your money can be like blindly navigating a maze. Budgeting applications try to guide, but not all are brilliant. Mint is known for its thorough tracking features, whereas YNAB addresses financial issues at their source. We’ll compare money management features of ynab vs. mint in this article.

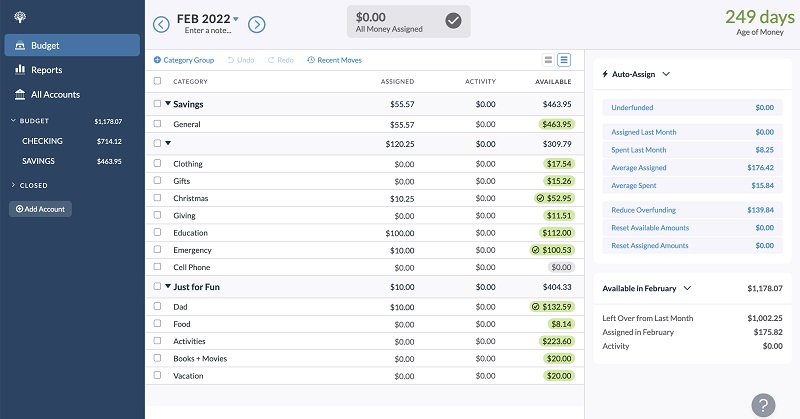

Every Dollar Has a Job

Giving every dollar a purpose is YNAB’s concept. This approach encourages thoughtful spending to avoid wasting money. Users see where their money is going by categorizing each dollar as bills, food, or savings. This proactive strategy helps customers make informed financial decisions, minimizing anxiety over overspending or missing important payments.

Mint prioritizes retrospective tracking over proactive budgeting. It sheds light on past spending habits but doesn’t assign future expenditures a role. Thus, users may react rather than manage financial events, causing financial instability.

Accepting Real Costs

YNAB’s “True Expenses” tool recognizes non-monthly expenses. Life has irregular but predictable costs, from annual subscriptions to car upkeep. YNAB advises users to save for these future expenses gradually to avoid last-minute scrambles or credit card debt. Users can handle financial surprises without stress or budget derailment by dividing down significant expenses into digestible parts.

Mint lacks a provision for irregular expenses. It gives expenditure trends but doesn’t offer a systematic way to predict and save for future expenses beyond basic budget categories. Thus, Mint customers may be surprised by irregular bills, increasing financial concern.

Rolling with the Punches

Budgeting requires flexibility, and YNAB’s “Roll with the Punches” mentality epitomizes this. YNAB advises users to adjust and reallocate finances rather than let unexpected expenses or budgeting mistakes ruin the budget. This proactive strategy builds resilience, helping people overcome financial challenges.

Mint’s budget deviation policy is strict. Users can alter budget categories, but there’s less emphasis on adapting allocations. Mint users may feel confined by predefined budgets, which might increase anxiety about unexpected expenses or income swings.

Focus on Financial Literacy

YNAB prioritizes financial education and budgeting tools to help consumers make smart financial decisions. YNAB creates a friendly environment for learning and growth through online workshops and educational resources. YNAB helps customers confidently manage their finances by demystifying financial concepts and encouraging a proactive approach.

While Mint includes some educational content, its major focus is transaction tracking and budgeting. Mint customers may feel alone in their financial journey due to the lack of a comprehensive teaching platform, raising financial literacy and decision-making concerns.

Conclusion

Finally, Mint and YNAB both offer personal finance management tools, but their methodologies differ. YNAB’s proactive budgeting, genuine expenses, financial awareness, and flexibility make it a holistic money management solution. By addressing the core causes of financial worry and equipping users with tools and information, YNAB helps users achieve financial peace of mind and eliminate money management problems.