Introduction

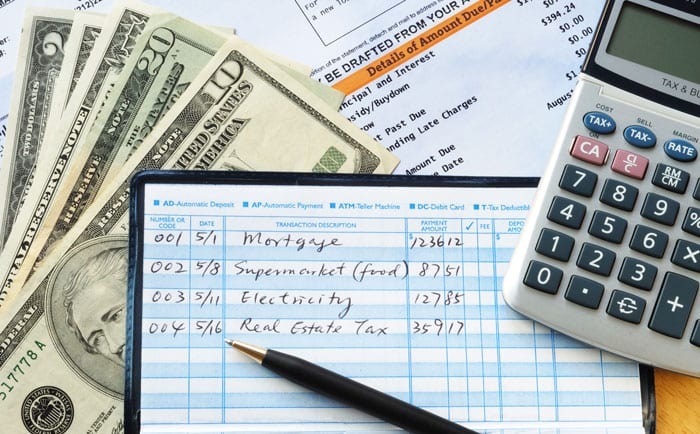

Everybody necessities to supervise individual budget and cost, yet two or three people are productive in it. It is an issue for certain people. You can without a very remarkable stretch arrangement with your money and cost. Once more, there is a request that might be to you — How? The reaction is through a singular budget app. Yet this blog is about the top benefits of individual budget apps, as yet, showing up at its impending portion right after scrutinizing some associated data would be enormously gotten to the next level. Subsequently, we ought to start this blog. You can likewise see here more about what is better ynab or mint? and expand your perspectives regarding the matter. A reality supervising finance and controlling spending is an especially difficult work. Observing costs in a week or a month is undesirable in case one necessities to move between different pages or receipt to receipt.

Quick Management of Finance

A couple scrutinizes could say that they can do it with the help of a Succeed sheet. It’s everything except a basic endeavour for specific people in light of the fact that not all ought to be experts in dealing with bookkeeping sheets and applying the conditions to the fragments. As indicated by the challenges point of view each and every one of us can look while examining regulating individual budget are: Spending without orchestrating, Emi’s, Home development, Getting cash from someone, Excess spending on festivals then again more. Is there a way by which I can without a very remarkable stretch arrangement with my singular bookkeeping? A singular budget app can help you with doing it quickly or without any problem. Some apps exist keeping watch, like Mint, in light of the headway of money the executive’s app improvement. These apps help clients truly to manage their money.

Need for the Individual Budget Apps

The good thing about the individual budget the board apps go with all components and functionalities that a client needs to manage their own expense and get cash in a month. While using the singular bookkeeping app, clients have a clearer point of view on the most capable technique to spend in a controlled way, so their spending targets ought to meet, including saving money. The most appealing thing about individual budget apps is that they license you to manage your funds from wherever and at whatever point, even while going in a metro or flight. These apps track your spending, suggest you a predominant technique for the board, and bind you from worthless spending. By and large, we will learn about the various benefits of using these apps. Plus, encouraging these apps for business is an unbelievable technique for making pay, as a fintech programming improvement association can help you with offering your clients a noteworthy money related administration experience.